Stressed by Student Loan Debt?

Getting a great education can open doors, help you build a great network, and help you learn about and land great jobs, but good education is not cheap.

Without making changes, it can take over

20 years to pay off your student debt.

According to Experian, among student borrowers, the average student loan debt is over $38,000 for undergrads.1

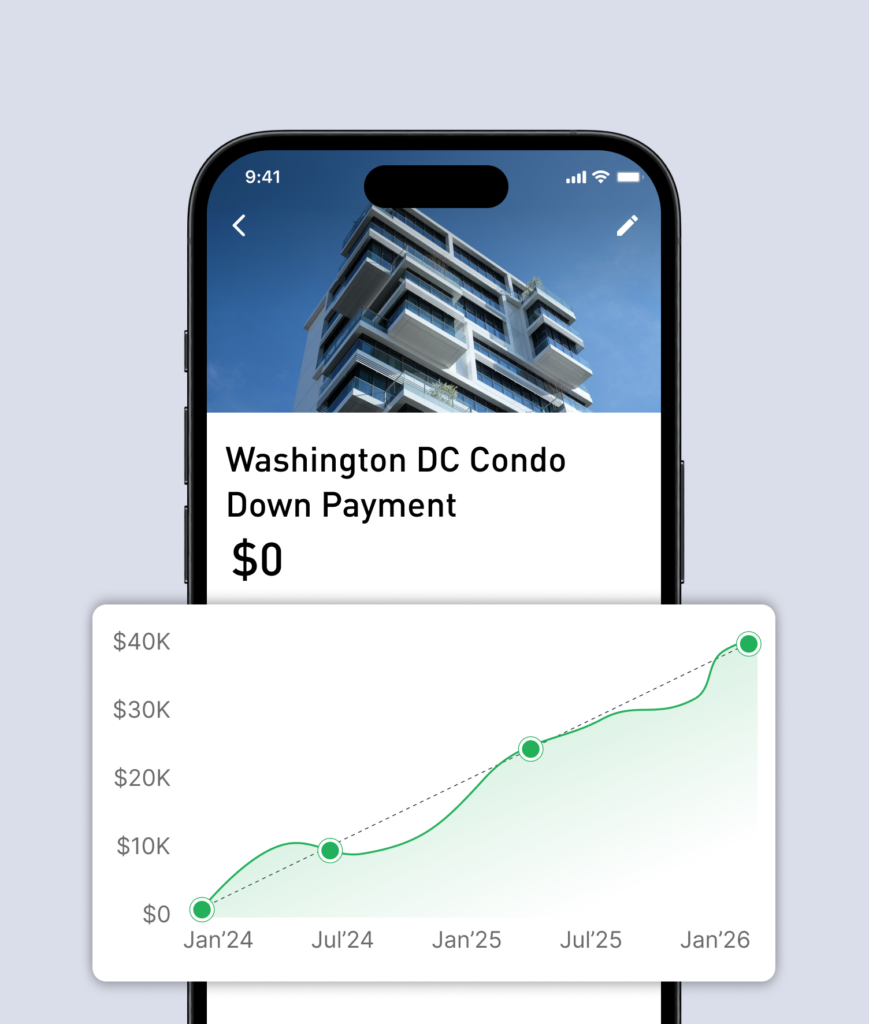

Benjamins Money software leverages your most

important financial metrics to help develop your

Day Zero Debt Plan

What does it take for you to get to day zero debt?

There are tradeoffs. You might have to forgo doing something today so you can accelerate your path to financial freedom and being debt-free tomorrow.

The Benjamins Money Five-Step Wealth Management/ Accumulation Process TM

At Benjamins Money we help you organize your income and funds for to maximize benefit.

Establish

your debt amount to be paid and your scheduled loan ending date

Verify

your current interest rate, set a goal for loan payoff

Optimize

your financial resources to accelerate your path towards loan payoff

Implement

your action plan to to automate your debt reduction plan

Review

your goal progress and make adjustments when needed

Achieve Financial Independence!

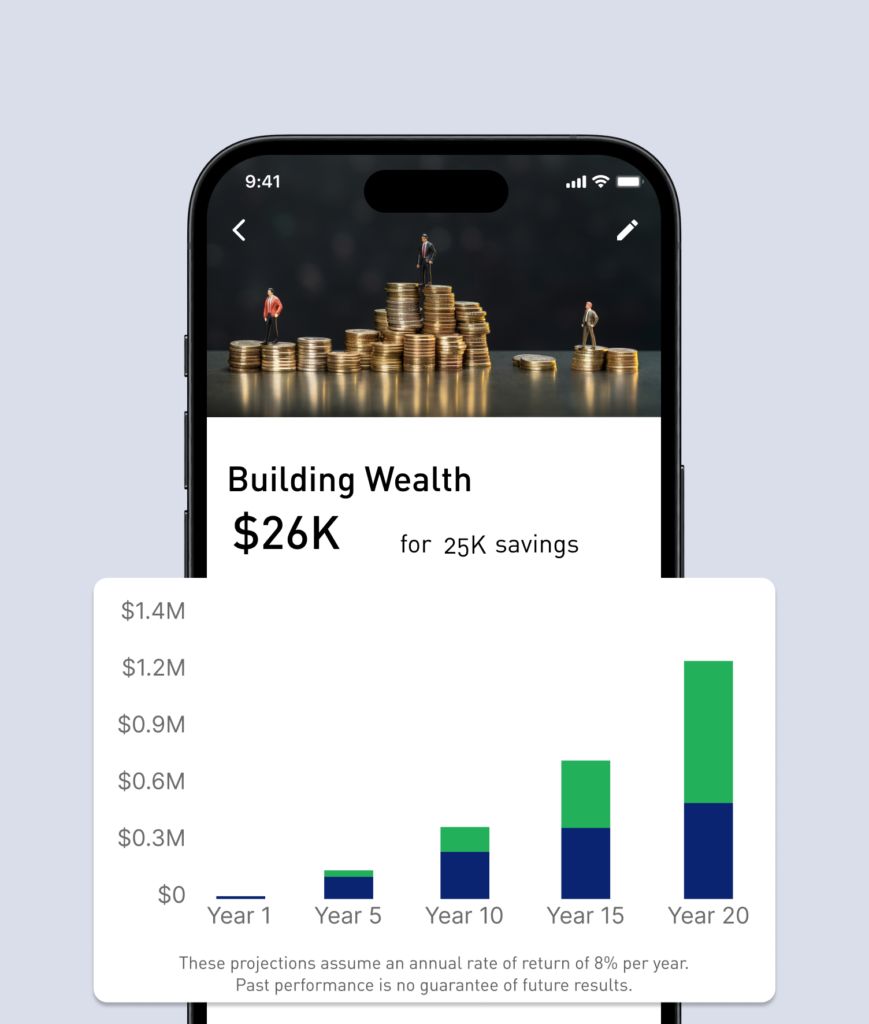

Benjamins Money is a digital wealth management platform designed to help young professionals save more money and optimize their financial resources so they can save more money.

- https://edition.cnn.com/cnn-underscored/money/average-student-loan-debt ↩︎

- https://educationdata.org/average-medical-school-debt ↩︎

- https://www.americanbar.org/content/dam/aba/administrative/young_lawyers/2021-student-loan-survey.pdf ↩︎

- https://poetsandquants.com/2023/11/19/mba-debt-burden-at-the-top-50-u-s-business-schools-where-grads-owe-the-most-least/ ↩︎